Seriously, this is nonsense.

I forgot that I have a Paypal subscription that drew money from my savings account.

But I keep all my balance in the checking account so it kept draining the savings account balance and it eventually ran out.

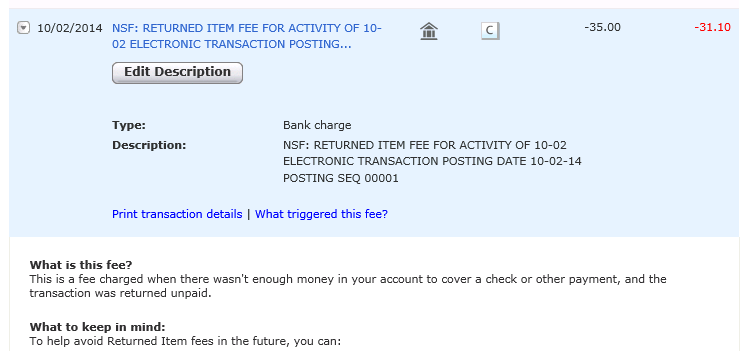

Then I received $35 fee for Non Sufficient Funds.

I did have overdraft protection linked to my checking account but I just now figured that it only works savings->checking and not vice versa.

Meh, one must be out of mind to think that the bank needs to collect that money because there is more stuff to be reconciled.

It might have been the case 100 years ago but it is plain scam to collect the very same amount of money in 21th century where computers do all the work.

And the trasaction is supposed to go through but with new laws they made it impossible to pay online services by overdraft account.

So that means I lost $35 for completely nothing.

Also, I discovered it only because I received a mail from Paypal for failed transaction notice. Otherwise if they didn’t let me know I would have been charged extra late fees.

I had 10 minute talk with the manager but had no success.

Anyway, people say that the overdraft protection service is quite misleading and it causes this to happen.

Proper way to prevent NSF fees is not to enroll in the overdraft protection, but to opt out of it.

In that case the transaction will simply be declined without any extra charges.

Screw you, Bank of America